Dear Investor,

Crypto asset performance was a mixed bag during September, as the FOMC meeting loomed over markets early in the month while regulatory developments spurred optimism as September came to a close.

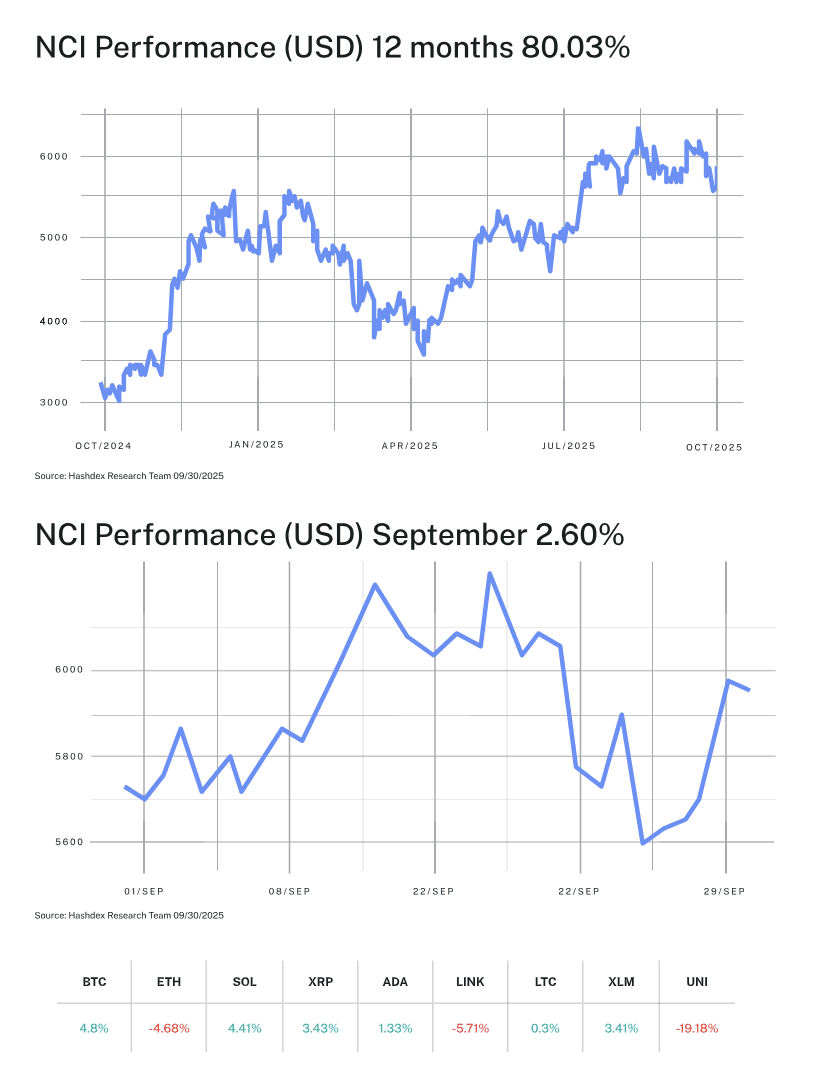

The Nasdaq Crypto IndexTM (NCITM) rose 2.60%, with Solana (SOL) posting the strongest performance, rising 16.85%. Bitcoin rose over 5.03% while Ethereum fell 6.77%. The dispersion of performance we saw during the month is a good reminder of what diversification in crypto can benefit investors, something we cover in detail in our recently released report.

To go even deeper into the benefits of crypto index investing and how recent regulatory changes will impact this space for years to come, we are hosting a webinar on Tuesday, October 7. You can register here.

As always, we are greatly appreciative of your trust in us and are here to answer any questions you may have.

-Your Partners at Hashdex

Market Review

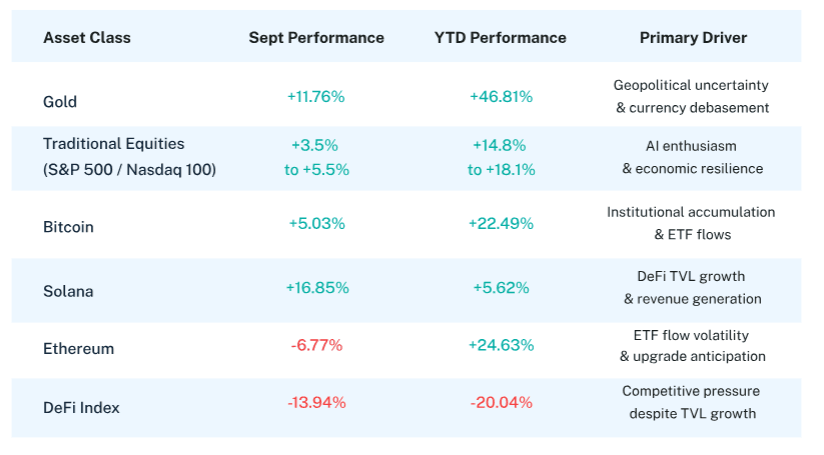

September 2025 delivered a subtle but significant message: crypto assets are maturing beyond monolithic risk-asset behavior. While the Nasdaq Crypto IndexTM (NCITM) posted a modest 2.60% gain, the performance beneath the surface told a more nuanced story. Solana surged 16.85%, Bitcoin gained 5.03%, yet Ethereum declined 6.77% and DeFi indices fell 13.94%. This extreme dispersion—occurring during the Federal Reserve's first rate cut and the SEC's approval of generic crypto ETF listing standards—marks a departure from the high-correlation "risk-on/risk-off" patterns that dominated earlier in 2025.

Traditional markets continued their ascent, with the S&P 500 gaining 3.53% and the Nasdaq-100 rising 5.47%, both hitting fresh record highs. Gold emerged as September's dominant performer with an 11.76% monthly gain, bringing its year-to-date return to a staggering 46.81%. This outperformance of traditional safe-haven assets reflects persistent geopolitical uncertainty and concerns about currency debasement—themes that typically favor crypto assets but manifested differently this time.

The Federal Reserve's September 17 decision to cut rates by 25 basis points to 4.0%-4.25% represented the first easing of 2025. Chairman Powell characterized it as a "risk management cut" aimed at supporting a softening labor market while maintaining progress on inflation. Markets had priced in this move with over 90% probability, limiting immediate volatility. More significantly, the dot plot signaled two additional cuts before year-end, suggesting a gradual easing path rather than aggressive accommodation.

That same day, the SEC approved generic listing standards for crypto ETPs beyond Bitcoin and Ethereum, ending over a decade of regulatory uncertainty and reducing approval timelines from 270 days to approximately 75 days. This decision enables Solana, XRP, Cardano, and other altcoin ETPs in Q4 2025. More about these changes can be found here.

Bitcoin demonstrated relative strength with its 5.03% gain, continuing to trade in a $108,000-$116,000 range throughout September. Institutional accumulation remained robust, with U.S. spot Bitcoin ETFs reaching $219 billion in assets under management by month-end. On September 30 alone, these ETFs absorbed $429 million in a single day. MicroStrategy added $449 million in BTC purchases during the month, while Tether acquired 8,888 BTC in Q3 at an average price of $112,500. The steady institutional flow underscores Bitcoin's position as the digital asset sector's blue-chip holding.

Ethereum's 6.77% decline surprised many observers, particularly given the regulatory tailwinds and its 24.63% year-to-date gain. The pullback reflected a 92% collapse in ETF inflows from August's $3.9 billion to just $285 million in September—though a dramatic $547 million single-day inflow on September 29 hinted at renewed institutional interest. The Fusaka network upgrade, scheduled for December 3, promises an 8x throughput increase via PeerDAS technology, potentially catalyzing renewed momentum. Despite the monthly decline, Ethereum's ecosystem fundamentals remain robust, with the network settling the majority of stablecoin transactions and maintaining dominance in DeFi applications.

Solana emerged as September's star performer with a 16.85% surge, driven by explosive DeFi growth. Total value locked on Solana reached $12.2 billion, representing 165% year-over-year growth from $4.63 billion. More impressively, Solana's 2025 revenue of $1.25 billion exceeds Ethereum's $523 million by a factor of 2.5, validating its high-performance architecture for real-world applications. The network processed 2.9 billion transactions in August alone—matching Ethereum's lifetime volume—while maintaining its position as the second-largest blockchain by DeFi TVL after Ethereum. With a Solana ETF approval estimated at 95% probability by October 10, institutional validation appears imminent.

Thematic indices reflected the month's turbulence. The Decentralized Finance (DeFi) index declined 13.94%, bringing its year-to-date loss to 20.04%—a puzzling disconnect given that total DeFi TVL reached $160-170 billion, approaching the November 2021 all-time high of $177 billion. This suggests markets are pricing in future competitive pressures or regulatory concerns despite current fundamental strength. The Smart Contract Platform (Web3) index fell 4.08%, while the Digital Culture (META) index declined 2.82%, extending its challenging year-to-date loss to 40.59%. The Vinter Hashdex Risk Parity Momentum (HAMO) index posted a modest 2.72% decline, demonstrating the value of systematic strategies during periods of elevated dispersion.

The Dispersion Paradox: When Correlation Breaks, Markets Mature

September's extreme performance dispersion deserves careful examination. In March, the 6-month rolling correlation between NCI and Nasdaq-100 surged to 0.91 as tariff uncertainty triggered synchronized selling across risk assets. September's divergent results suggest continued decoupling from traditional markets. When Bitcoin gains 5%, Ethereum falls 7%, and Solana surges 17% during the same month, we're witnessing asset-specific price discovery rather than beta-driven momentum.

This dispersion reflects crypto's maturation along multiple dimensions:

This table reveals that each asset class now responds to distinct fundamental drivers rather than moving in lockstep with macro sentiment. Gold benefited from geopolitical tensions and dollar weakness (DXY down 10.24% year-to-date). Traditional equities rode AI optimism and corporate earnings. Bitcoin attracted institutional treasury allocation. Solana capitalized on ecosystem growth. Ethereum navigated the transition from speculation to infrastructure. DeFi tokens struggled despite protocol success—a classic late-cycle phenomenon where equity holders don't capture all value.

The September 17 trifecta—Fed rate cut, SEC crypto ETF approval, and continued institutional accumulation—would have triggered a unified crypto rally in 2021. Instead, we saw differentiated responses based on protocol-specific fundamentals, regulatory clarity, and competitive positioning. This is precisely what asset class maturation looks like.

ETF Asymmetry: Institutional Preference Revealed

September exposed a striking asymmetry in crypto ETF adoption. Bitcoin ETFs maintained strong momentum with $429 million in single-day inflows on September 30, pushing total AUM to $219 billion. BlackRock's IBIT alone commands $86 billion, demonstrating that institutional demand for Bitcoin exposure remains robust. In contrast, Ethereum ETFs experienced a 92% collapse in monthly inflows from August's $3.9 billion to September's $285 million—despite both products operating under similar regulatory frameworks.

This divergence reveals institutional investor preferences at this stage of adoption. Bitcoin's narrative as digital gold, combined with its longer operational history and superior liquidity, makes it the default crypto allocation for conservative institutional portfolios. Ethereum's more complex value proposition—requiring understanding of smart contracts, DeFi, staking yields, and network upgrades—faces longer adoption timelines despite its technological sophistication. The September 29 single-day $547 million Ethereum ETF inflow suggests this is timing rather than permanent preference, but the asymmetry matters for near-term price dynamics.

Looking Ahead: Q4 Catalysts Align

As we enter the final quarter of 2025, multiple catalysts position crypto assets for renewed strength:

Monetary Policy Easing: The Fed's September rate cut marks the beginning of an easing cycle, with two additional cuts projected before year-end. Lower rates reduce the opportunity cost of holding non-yielding assets like Bitcoin while making crypto's native yields (staking, DeFi lending) more attractive on a relative basis.

Altcoin ETF Approvals: The SEC's approval of generic crypto ETF listing standards opens the floodgates for Solana, XRP, and Cardano ETFs in Q4. History suggests these launches will drive both direct flows into new products and broader awareness of crypto's diversification benefits.

Network Upgrades: Ethereum's December 3 Fusaka upgrade promises transformative scaling improvements. If successful, it could catalyze the long-anticipated DeFi institutional adoption that has remained elusive despite regulatory clarity.

Institutional Momentum: With 35% quarter-over-quarter growth in institutional crypto adoption and corporations now holding 6% of Bitcoin's total supply, the trajectory points toward continued accumulation. The maturation of custody solutions, trading infrastructure, and accounting standards removes barriers that previously limited institutional participation.

Geopolitical Hedging: Gold's 46.81% year-to-date gain reflects persistent concerns about currency debasement and geopolitical instability. As these themes persist, crypto assets—particularly Bitcoin—offer a digital alternative to physical safe-haven assets with superior portability and divisibility.

September's modest 2.60% NCI gain, while unremarkable in isolation, signals a fundamental shift in how crypto markets function. The extreme dispersion, ETF asymmetry, and decorrelation from traditional risk assets all point toward an asset class transitioning from speculative instrument to institutional infrastructure. Individual protocol fundamentals now matter more than macro sentiment—a development that favors systematic, diversified exposure through market cap-weighted indices like the NCI.

The convergence of traditional finance and digital assets continues, but September proved that this integration will be selective rather than wholesale. Quality protocols with real usage, regulatory clarity, and institutional adoption will command premiums. Speculative tokens without fundamental value drivers will struggle. For investors seeking exposure to crypto's transformative potential while managing single-asset volatility, the NCI's disciplined approach offers optimal participation in this maturing ecosystem.

Top Stories

Hester Peirce signals urges swift progress

SEC Commissioner Hester Peirce has signaled a significant shift in the agency's approach to crypto regulation, switching gears from the SEC's previous stance and expressing hope for a future of regulatory clarity. This shift in regulatory tone suggests a potentially collaborative approach for crypto in the US, bringing more stability and incentives to the ecosystem.

EU ministers pave the way for digital Euro

The European Union has reached a compromise on the digital euro, granting members influence over its potential launch while setting holding limits to reduce the risk of bank runs. Marking a key step toward a digital euro, this initiative offers a strategic alternative to US-dominated payment systems and highlights collaboration between the ECB and EU in shaping central bank digital currencies.

Hong Kong softer bank capital rules for crypto

Hong Kong Monetary Authority has drafted guidance proposing more lenient capital requirements for banks to hold certain regulated crypto.

By easing the capital burden on banks involved with digital assets, regulators aim to encourage greater institutional participation and integrate crypto more deeply into the mainstream financial system, aligning with global standards from the Basel Committee.

_________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds.

The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or ser vice. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction.

These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex.

By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or other wise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and crypto assets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may var y substantially over time.

Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.” These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis.

Certain information contained herein (including financial information) has been obtained from published and unpublished sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes for ward-looking statements, which can be identified by the use of terms such as “may,” “ will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof ) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such for ward-looking statements.

As a result, investors should not rely on such for ward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulator y authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any digital asset or any representation about the financial condition of a digital asset. Statements regarding Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate assets before investing. ADVICE FROM A FINANCIAL PROFESSIONAL IS STRONGLY ADVISED.