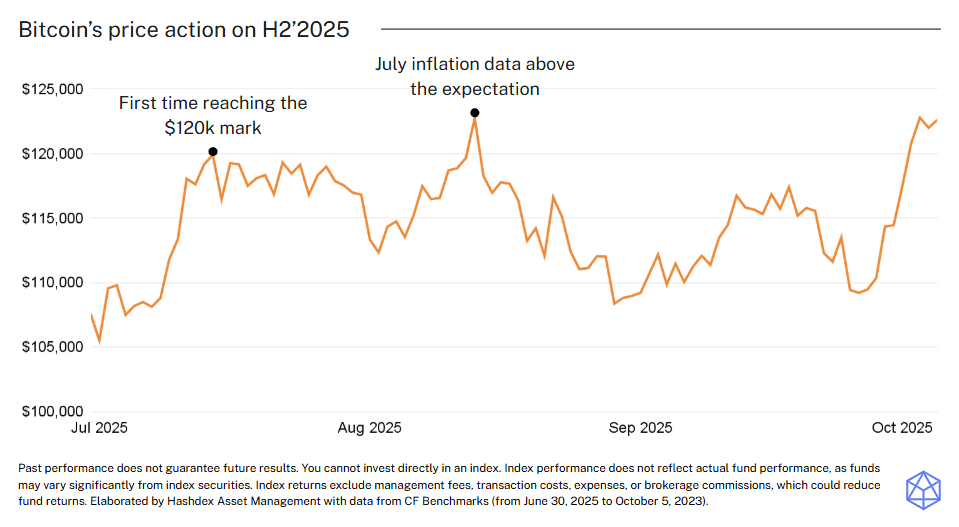

Chart of the week

September marked the third consecutive month of sideways movement for Bitcoin since its all-time high on July 14. As we enter October, Bitcoin has once again crossed the $120,000 mark—its third time this semester. But this time, the backdrop feels different.

Beyond stronger fundamentals and improving macro conditions, we’re seeing meaningful institutional validation. Morgan Stanley’s Global Investment Committee recently formalized Bitcoin within its portfolio allocation models—a landmark moment signaling Bitcoin’s entry into traditional asset frameworks. At the same time, the SEC approved new listing standards for crypto funds, and Commissioner Hester Peirce publicly called for faster regulatory progress.

September marked the third consecutive month of sideways movement for Bitcoin since its all-time high on July 14. As we enter October, Bitcoin has once again crossed the $120,000 mark—its third time this semester. But this time, the backdrop feels different.

Beyond stronger fundamentals and improving macro conditions, we’re seeing meaningful institutional validation. Morgan Stanley’s Global Investment Committee recently formalized Bitcoin within its portfolio allocation models—a landmark moment signaling Bitcoin’s entry into traditional asset frameworks. At the same time, the SEC approved new listing standards for crypto funds, and Commissioner Hester Peirce publicly called for faster regulatory progress.

Unlike in August, when data delays and fiscal uncertainty weighed on sentiment, this October begins with clearer direction and growing confidence. With regulatory momentum and institutional endorsement aligning, Bitcoin may now be positioned to break into new highs—continuing its historically strong performance for the month.

Market Highlights

Morgan Stanley recommends crypto

In its latest report, Morgan Stanley has advised clients to include bitcoin on their investments portfolio.

The suggestion of a “small” 2–4% allocation implies tens of billions in potential inflows and could be a great catalyst to institutional adoption.

By calling Bitcoin a “scarce digital asset,” Morgan Stanley legitimizes the crypto narrative — marking its shift from rebellion to orthodoxy and pressuring peers to follow suit.

Standard Chartered trillion inflow to stablecoins

Standard Chartered has estimated that up to a trillion could exit emerging market bank deposits and flow to stable coins by late 2028.

Such a shift would deepen global demand for stablecoins, expand on-chain liquidity, and reinforce the role of crypto markets as parallel financial rails—probably accelerating institutional focus on crypto.

CME 24/7 crypto future trading

CME Group said they will move crypto futures and options to nonstop trading in early 2026.

This is another step toward integrating crypto into the global capital markets framework, as it reduces segmentation between traditional and digital markets—and validates crypto derivatives as important products.