1. CHART OF THE WEEK

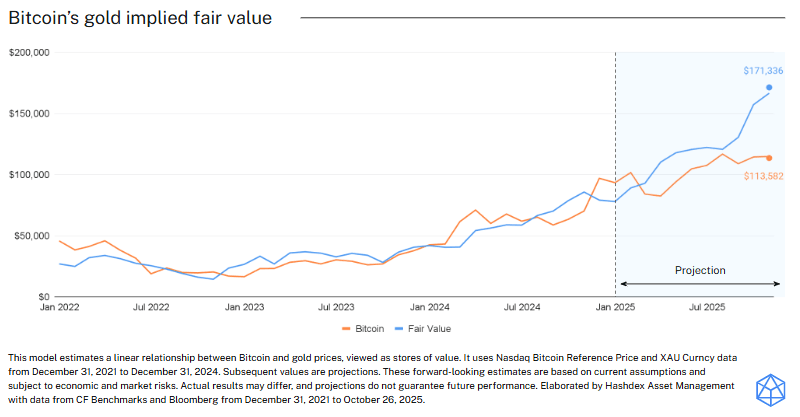

Because of its scarcity, bitcoin is often referred to as “digital gold”. While this label doesn’t assume a strong correlation between the two assets, investors tend to associate them as stores of value.

Modeling bitcoin’s price relative to gold reveals that, despite modest correlation, both assets show an underlying value connection—bitcoin and its gold-based fair value tend to move somewhat in tandem.

In recent months, as gold prices rallied, the gap between bitcoin and its fair value reached its maximum, widening to nearly 51%.

With gold’s recent pullback, this may signal a liquidity rotation from gold into other risk assets like bitcoin, hinting that the previous gold rally could foreshadow a broader move within store-of-value assets.

2. MARKET HIGHLIGHTS

Trump picks Michael Selig to lead CFTC

-

President Trump nominated Michael Selig, a former SEC crypto legal advisor, to chair the Commodity Futures Trading Commission (CFTC).

-

With his background in traditional markets and digital assets he understands both the need for tech innovation and legal clarity.

-

This could signal a potentially more crypto-friendly CFTC, paving the way for clearer rules on derivatives and market structure, further boosting adoption and innovation.

JPMorgan to accept BTC and ETH as collateral

-

JPMorgan will let institutional clients pledge Bitcoin and Ethereum as collateral for loans, with assets held by third-party custodians.

-

A new mainstream use for crypto could strengthen the link with TradFi, expanding BTC/ETH’s use as financial assets and reinforcing their long-term value case.