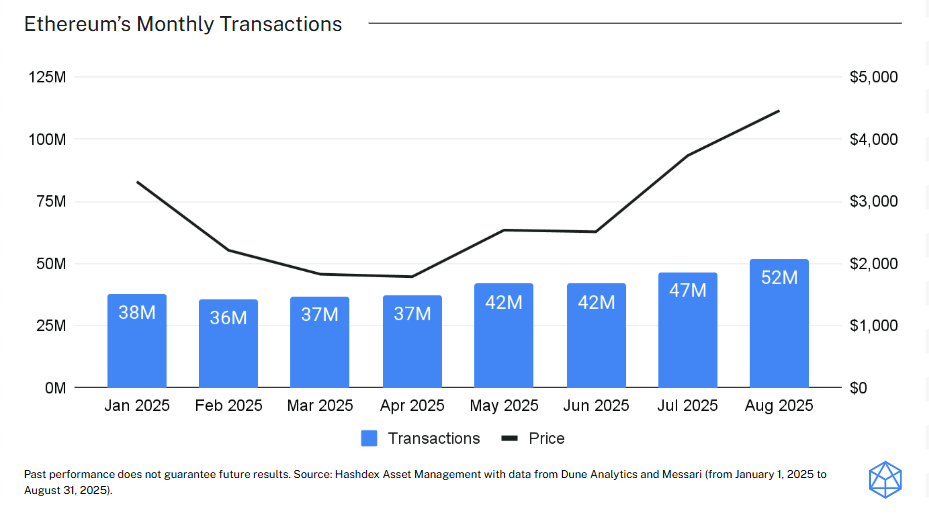

Chart of the week

Earlier Hash Insiders reported that U.S. ETF flows chased ETH’s price higher, producing substantial inflows after the surge.

A similar dance now unfolds on-chain with the transaction volume matching the recent price surge. What could make this truly compelling is that this wave of activity comes despite the higher dollar cost to transact in the blockchain, a potential testament to the network's pull.

During this consolidation, ETH’s core fundamentals — on-chain activity and institutional adoption — have improved. If these fundamental patterns persist and demand for ETH and the Ethereum ecosystem remains strong, it could provide support for relatively stronger ETH performance in the coming months.

Market Highlights

U.S. Government data on public blockchains

The U.S. Department of Commerce is now publishing key macroeconomic data on public blockchains like Ethereum and Solana.

This initiative embraces blockchain technology for data distribution, enhancing transparency and accessibility. It reflects a broader trend of integrating digital assets into governmental routines.

Japan Post Bank to roll out a deposit token

Japan Post Bank is planning to allow its 120 million customers to convert their savings into tokenized deposits for purchasing tokenized securities.

By making it easier for retail investors to access these new investment vehicles, it could drive demand for digital assets and foster a more inclusive financial ecosystem.

Ethereum on-chain volume hits 4-year high

Ethereum's on-chain volume surged to over $320 billion in August, its highest level since May 2021.

The surge in on-chain activity suggests a growing utility and adoption of the Ethereum network, pointing to a strong underlying demand for its blockspace, consolidating its position as a leading smart contract platform.