Two years ago, I wrote about the investment case for Ethereum (ETH), suggesting that the eldest smart contract platform was crypto’s “sleeping giant.” At the time, ETH was trading around $1,600 and many questions surrounded its future as its competition was increasing and the impact of recent upgrades was unclear.

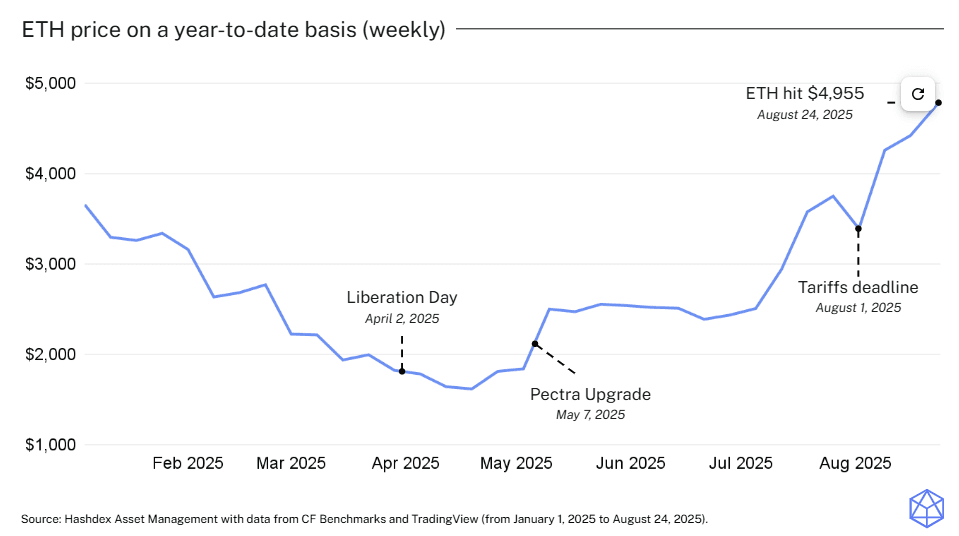

But today, growing optimism around America’s embrace of stablecoins—which rely on Ethereum and other smart contract platforms—easing geopolitical tensions, and accelerating inflows into ETH ETFs has helped push ETH to nearly $5,000 last week, a new all-time high.

Ethereum’s journey

One enduring lesson I’ve learned from navigating crypto markets over the last decade is that transformative ecosystem shifts often unfold during periods of apparent quiet, away from the spotlight of hype and volatility. This is, in part, why our team strongly believes in the power of index investing in crypto—it can help transcend short-term narratives.

Ethereum is a great example of this. It was perceived by some as stagnant two years ago, yet, as highlighted in my September 2023 note, foundational progress in infrastructure, tokenization, and adoption was quietly building momentum. Fast-forward to today, and Ethereum has not only validated that optimism but accelerated it.

With ETH trading near all-time highs—up over 100% from its early 2024 lows—the platform's role as the premier smart contract blockchain is more entrenched than ever. Institutional inflows, technological upgrades, and real-world applications have propelled Ethereum into a new phase of maturity, making its investment case compelling for long-term holders. Let's look at the three core pillars I laid out in 2023 and how I believe they are combining with recent developments to strengthen Ethereum's potential.

-

Infrastructure developments: Staking and scalability milestones

Ethereum's shift to a Proof-of-Stake (PoS) network in 2022 marked a pivotal moment, enabling staking (which allows network participants to earn ETH or other crypto assets) and positioning ETH as a yield-bearing asset, akin to traditional bonds. Two years on, this foundation has matured dramatically. Staked ETH has surged to approximately 36 million, representing about 29% of total supply—a significant increase from 2023. This growth reflects heightened network security and investor confidence, with staking rewards averaging a 2.9% APR, appealing to yield-focused portfolios.

Key upgrades have further enhanced Ethereum's infrastructure. The Dencun upgrade in March 2024 helped reduce transaction costs and boosted throughput while another upgrade this year helped optimize the efficiency of the network. These enhancements have helped make Ethereum more accessible for everyday applications.

A major catalyst has been the approval and performance of spot Ethereum ETFs. Following a flurry of applications in 2023, the SEC greenlit them in mid-2024. By August 2025, these funds have amassed over $23 billion in assets under management. This institutional embrace has driven sustainable demand and, as regulatory clarity solidifies, Ethereum is increasingly viewed as a core allocation, akin to tech stocks with measurable metrics.

-

Tokenization trends

In 2023, tokenization of real-world assets (RWAs) was projected by Bank of America to reach $16 trillion over 5-15 years. That vision is materializing faster than anticipated. By mid-2025, the RWA tokenization market has ballooned to $24 billion—up from $5 billion in 2022. Public blockchain tokenized RWAs alone hit $18 billion early in the year. Ethereum's smart contract dominance enables this, fractionalizing assets like real estate, art, commodities, and securities into blockchain tokens for seamless trading and liquidity.

BlackRock CEO Larry Fink, who in 2023 called tokenization a potential finance revolution, reiterated his bullish stance in 2025, emphasizing Bitcoin and Ethereum's roles in democratizing assets. BlackRock's own tokenized fund is on track to become the largest, underscoring institutional buy-in. And with the passage of the GENIUS Act in the US, stablecoins are set to boom. Stablecoin supply on Ethereum has already reached $155 billion, helping to fuel decentralized finance and cross-border payments.

-

Generational shift

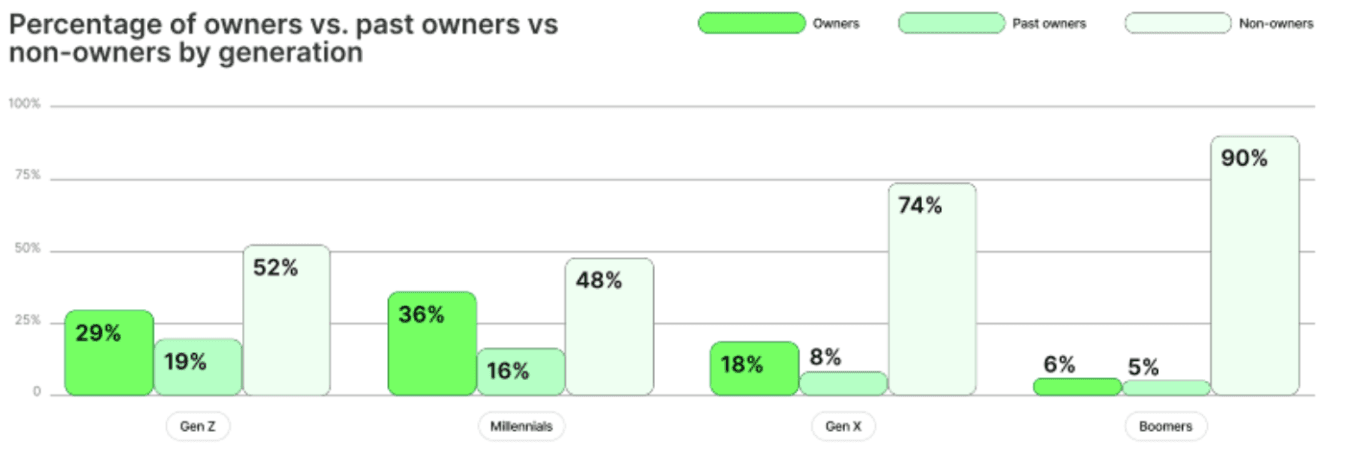

In my 2023 note, I pointed out that younger generations have a much greater, intuitive grasp of digitization. By 2025, this divide has widened. Over 50% of Gen Z now owns crypto, leading adoption alongside Millennials. With over $100 trillion set to move from older to younger generations over the next two decades, their economic influence is amplifying.

Source: Gemini Global State of Crypto, 2025 Report

This shift mirrors historical tech adoption—credit cards in the 1990s or the internet's rise. Skepticism from older cohorts persists, but a decade into its existence and Ethereum’s utility is undeniable, much like how we now can't imagine life without smartphones.

ETFs are playing an important role as well. Two in five crypto owners in the US are invested in crypto ETFs and adoption has increased following the approval of spot crypto ETFs in 2024. According to a recent report from Gemini, 39% of crypto investors in the US own crypto ETFs, up from 37% in 2024.

The opportunity in 2025 and beyond

Ethereum's trajectory, particularly in recent months, proves its perceptions of dormancy were wrong. In 2025, ETH has outpaced Bitcoin (BTC), surging 59-60% YTD versus BTC's 10-11%, driven by upgrades and ETFs. Public companies like Bit Digital and Sharplink have bought billions in ETH, signaling corporate treasury adoption. My expectation is that ETH can surpass $10,000 once we start to see stablecoin solutions being implemented for US payments.

As infrastructure scales, tokenization explodes, and generations shift, ETH's role as global "plumbing" strengthens. This once-perceived sleeping giant is wide awake, potentially poised to drive innovative investing for decades. While volatility and regulatory hurdles remain, we believe a disciplined, long-term approach to investing in crypto is key. Institutional-grade indexes like the Nasdaq Crypto Index can help investors get exposure and benefit from Ethereum and the other foundational technologies that are building our digitized economy.

_________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds.

The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or ser vice. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction.

These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex.

By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or other wise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and crypto assets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may var y substantially over time.

Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.” These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis.

Certain information contained herein (including financial information) has been obtained from published and unpublished sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes for ward-looking statements, which can be identified by the use of terms such as “may,” “ will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof ) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such for ward-looking statements.

As a result, investors should not rely on such for ward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulator y authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any digital asset or any representation about the financial condition of a digital asset. Statements regarding Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate assets before investing. ADVICE FROM A FINANCIAL PROFESSIONAL IS STRONGLY ADVISED.