I had a fascinating conversation with an advisor last week that reminded me of two concepts that investors often use interchangeably: volatility and risk.

At first glance, they may sound similar. But for anyone building or managing portfolios, especially those that include growth assets like crypto and equities, the differences are profound. Understanding these distinctions is critical not just for managing money, but for managing behavior, which is often the true determinant of long-term investment success.

Volatility ≠ Risk

Volatility is one of the most misunderstood words in investing. It’s typically defined as a measure of how much prices fluctuate over a given period. Statistically, it represents the dispersion of returns around a mean—a way of estimating how far prices might move from their average, based on the assumption that 1) the past reflects the future and 2) returns follow a normal (bell-curve) distribution.

These assumptions are convenient for academic models, but they rarely capture the realities of how markets behave—especially in an emerging, high-growth asset class like crypto.

More importantly, volatility and risk are not the same thing. In simple terms, volatility is a temporary movement in price while risk is the possibility of permanent loss.

Volatility does not cause losses on its own. Losses only occur when investors act on volatility by selling into downturns. In other words, what transforms volatility into risk isn’t large price swings, but how the investor responds to these events.

Volatility is inherently important in markets. While it’s unpredictable, uncomfortable, and at times extreme, it’s also the price of admission for higher potential returns. The risk of turning that volatility into permanent capital loss, on the other hand, is something investors can control through time horizon, position sizing, and emotional discipline.

The Advisor’s Role: Framing Volatility the Right Way

The distinction between volatility and risk is particularly important for financial advisors, who serve as both portfolio architects and behavioral coaches through the ups and downs of market cycles. The key is helping clients set realistic expectations and build strategies that can withstand the inevitable swings. Three principles are essential:

-

Invest only capital that won’t be needed within the investment horizon. In crypto, a four-year horizon (roughly one full market cycle) has historically been enough time for the long-term growth trend to overcome interim volatility.

-

Size allocations according to emotional tolerance, not just financial capacity. If a 30% drawdown would cause a client to lose sleep, the position is too large. No amount of backtesting or risk modeling can compensate for the impact of fear-driven decisions.

-

Focus on risk-adjusted returns. Narrowly looking at an asset through its volatility only can be limiting. An asset can be volatile and have the best risk-adjusted returns within a given portfolio.

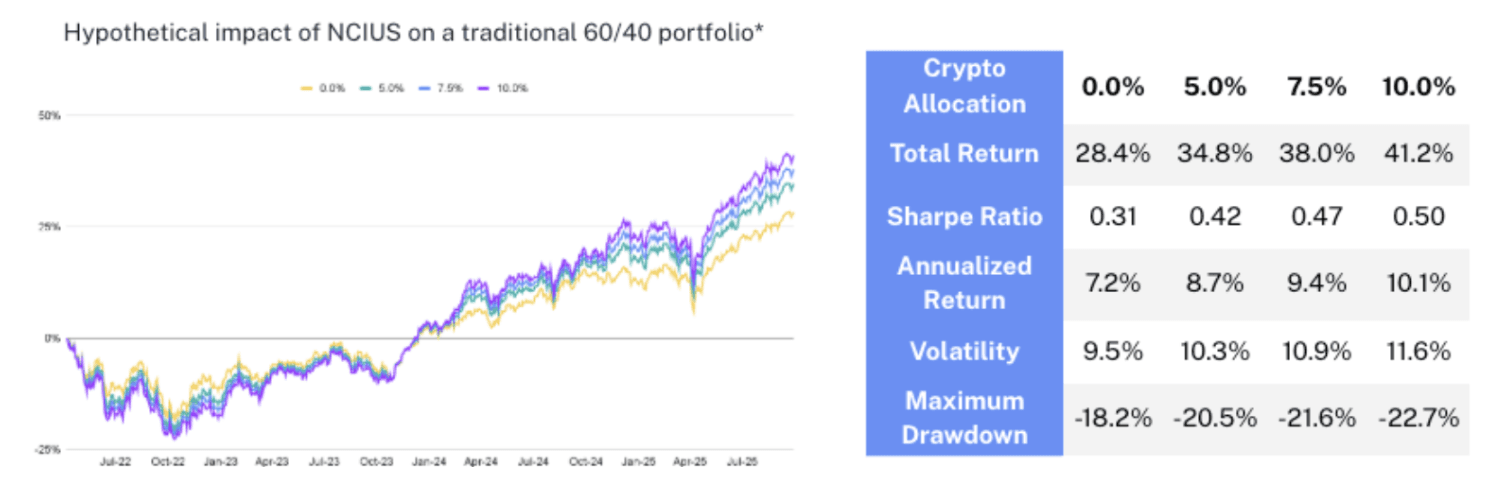

A 5-10% crypto allocation can improve risk-adjusted returns1

While Modern Portfolio Theory (MPT) can provide a useful framework for diversification and optimizing returns relative to risk, it doesn’t fully account for investor psychology.

Even the most rational investors are susceptible to emotional biases when confronted with red numbers. In practice, many investors check their portfolios too often, see near-term declines, and interpret volatility as loss. This triggers the instinct to “do something,” often selling the most volatile assets just before they rebound.

Ironically, the more diversified a portfolio is, the more visible these emotional triggers become. Dispersion between holdings naturally creates “winners” and “losers,” even if the portfolio as a whole is performing exactly as designed. When investors focus on individual line items rather than the overall strategy, they risk undoing the benefits of diversification by reacting to short-term noise.

This management of expectations is where advisors add enormous value. Regular, proactive conversations about volatility can prevent clients from turning temporary declines into permanent losses. The goal isn’t to eliminate volatility—that’s impossible and antithetical to price discovery—but to ensure clients don’t abandon a sound strategy midway through its journey.

Volatility is a Feature

For disciplined investors, volatility is an opportunity. It creates the conditions for rebalancing, one of the simplest and most effective long-term strategies. By systematically trimming positions that have appreciated and adding to those that have declined, investors are effectively buying low and selling high without trying to time the market. This process harnesses volatility rather than fearing it. Over multiple cycles, disciplined rebalancing can significantly improve risk-adjusted returns, all while reinforcing good behavioral habits.

In that sense, volatility isn’t just a test of patience, it’s an engine for long-term performance.

Crypto, in particular, offers a powerful illustration of this principle. Over the past decade, Bitcoin and Ethereum have experienced multiple drawdowns exceeding 50%, yet long-term investors who maintained their allocations or rebalanced into those declines have historically been rewarded with exceptional compounded returns.

Of course, past performance doesn’t guarantee future results. But the pattern is consistent across asset classes: markets tend to reward patience, not panic.

The Discipline Dividend

Investing is as much about temperament as it is about analysis. The best portfolios are not those that chase the highest returns, but those that can withstand the inevitable storms and allow compounding to do its work.

Volatility will always exist. It’s the reflection of millions of participants reacting to information, uncertainty, and emotion in real time. Investors can’t control that, but they can control their response.

True risk management, therefore, isn’t about eliminating volatility. It’s about cultivating the discipline to endure it. When advisors frame volatility as a test rather than a threat, clients begin to view market fluctuations differently—not as something to fear, but as something to navigate with confidence and purpose.

Because in the end, volatility doesn’t destroy wealth. A lack of discipline does.

1 * The crypto allocation in this analysis is represented by the Nasdaq Crypto Index US (NCI US), which had its inception on April 6, 2022. The Simulations ran from that date until September 30, 2025, with rebalancing occurring every 10 days. For comparison, the base portfolio without NCI US was composed of 60% MSCI ACWI and 40% Bloomberg Barclays US Aggregate Bond Index, both with total returns. Sharpe ratio calculated using the returns of 3-Month US Treasury Bills as the risk-free rate. Past performance is not indicative of future results; this information is for educational purposes only and does not constitute investment advice. All investments carry risk, including the potential loss of principal, and investors should consult with a financial advisor before making investment decisions. Any comparison to other indices is for illustrative purposes only and does not imply that the performance of the index will mirror that of another. Differences in methodology, composition, and weighting may result in performance variances. Past performance is not indicative of future results. Index performance is presented for informational purposes only and does not represent actual investment results.

_______________________________

The issuer has filed a registration statement (including a Prospectus www.hashdex-etfs.com/NCIQ/prospectus and a Prospectus Supplement) with the SEC for the offering to which this communication relates. Before you invest, you should read the Prospectus and Prospectus Supplement in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer will arrange to send you the prospectus and/or prospectus supplement if you request it by calling (917) 525-5635. Before making an investment decision, you should carefully consider the risk factors and other information included in the Prospectus and Prospectus Supplements.

The Fund, which is an ETP, is not a mutual fund or any other type of investment company within the meaning of the Investment Company Act of 1940, as amended, and is not subject to regulation thereunder.

An investment in any investment vehicle and crypto assets is highly speculative and is not intended as a complete investment program. It is designed only for persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may vary substantially over time. Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.”

The Hashdex Nasdaq Crypto Index US ETF (“Fund”) currently holds the crypto assets. Because the Fund's investment objective is to track the price of the Nasdaq Crypto US Settlement Price™ Index (NCIUSS) (“Index”) less expenses and liabilities of the Trust, changes in the price of the Shares may vary from changes in the spot price of crypto assets. An investment in the Fund involves significant risks and you could incur a partial or total loss of your investment in the Fund.

Some of the risks you may face are summarized below. A more extensive discussion of these risks appears in the “Risk Factors” section of the Prospectus.

Fund Risks

The Index has a limited performance history. Errors in Index data, Index computation or the construction of the Index in accordance with its methodology may occur from time to time and may not be identified and corrected by Nasdaq for a period of time or at all.

Crypto platforms may be largely unregulated or may be largely or entirely non-compliant with applicable regulation and may therefore be more exposed to fraud and failure. Crypto asset markets in the U.S. exist in a state of regulatory uncertainty, and adverse legislative or regulatory developments could significantly harm the Fund.

The market for crypto-based ETFs like the Fund may reach a point where there is little or no additional investor demand. If this happens, there can be no assurance that the Fund will grow to or maintain a viable size. Due to the Fund’s small asset base, certain of the Fund’s expenses and its portfolio transaction costs may be higher than those of a Fund with a larger asset base. To the extent that the Fund does not grow to or maintain a viable size, it may be liquidated, and the expenses, timing and tax consequences of such liquidation may not be favorable to some shareholders.

Crypto assets generally are volatile, and instruments whose underlying investments include crypto assets are not suitable for all investors. Crypto assets represent a new and rapidly evolving industry. The value of the Fund depends on the acceptance of the crypto assets, the capabilities and development of blockchain technologies and the fundamental investment characteristics of the crypto asset. Crypto asset networks are developed by a diverse set of contributors and the perception that certain high-profile contributors will no longer contribute to the network could have an adverse effect on the market price of the related crypto asset. Crypto assets may have concentrated ownership and large sales or distributions by holders of such crypto assets could have an adverse effect on the market price of such assets.

Liquidity Risk. The market for crypto assets is still developing and may be subject to periods of illiquidity. During such times it may be difficult or impossible to buy or sell a position at the desired price. Possible illiquid markets may exacerbate losses or increase the variability between the Fund's NAV and its market price. The lack of active trading markets for the Shares may result in losses on investors' investments at the time of disposition of Shares.

The Fund has a limited operating history.

The Fund holds crypto assets; however, an investment in the Fund is not a direct investment in crypto assets. The value of the shares may fluctuate more than shares invested in a broader range of industries. For more information, please visit the official index page.

As the Trust currently holds fewer assets than its benchmark index (NCIUS), it may experience tracking differences—positive or negative—relative to the index’s performance. The inclusion of any additional crypto asset to the Fund’s holdings will occur in accordance with the Index methodology and eligibility under the generic listing standards.

Paralel Distributors is the Marketing Agent of NCIQ. Hashdex Asset Management Ltd. is not associated with Paralel.