Crypto markets took a collective breath in May with volatility declining during the month for the Nasdaq Crypto IndexTM. This moderation in price swings, especially during a period of broader macro uncertainty, suggests the asset class is maturing with a more anchored market structure and a base of investors that better understands crypto’s opportunities and potential risks.

Ethereum (ETH), in particular, has been gathering steam. The dominant smart contracts platform has stood out as a relative outperformer with ETH climbing back to the $2,600 level after a 42% rise in May, marking a healthy rebound. As a result, the ETH/BTC pair, often seen as a barometer of relative momentum within the crypto ecosystem and a historical leading indicator of an altseason, began regaining force. This shift may reflect renewed interest in Ethereum and other smart contract platform's expanding use cases—including their growing role as the institutional infrastructure for stablecoins. We also have seen this interest reflected in ETH ETFs, which have seen increasing flows in recent weeks.

Ethereum ETFs inflows since inception

Stablecoins remain in the spotlight

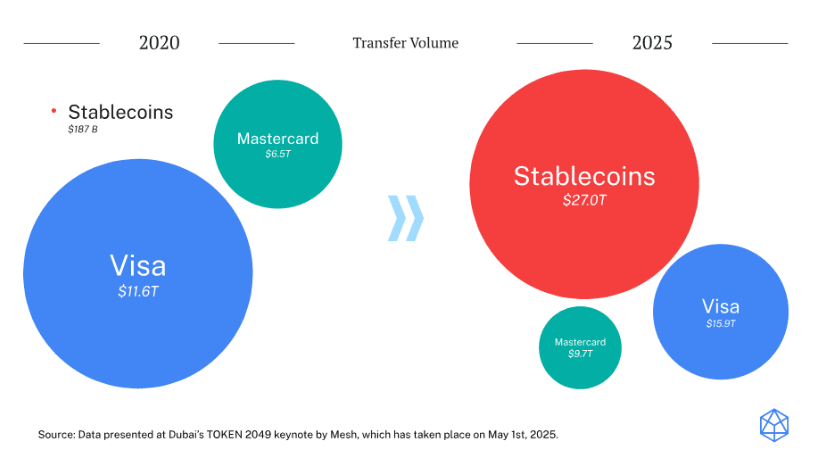

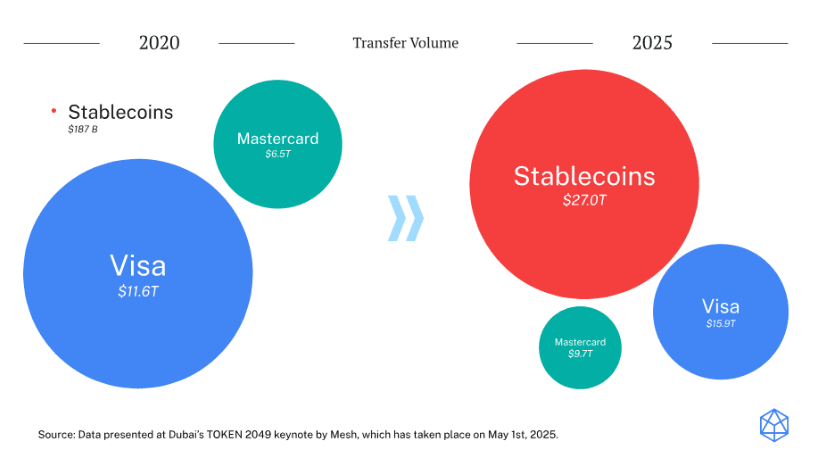

Stablecoins, which depend on Ethereum and other smart contract platforms for their underlying infrastructure, have been a focal point in recent weeks—but in a markedly different context than the speculative-driven growth of previous cycles. Stablecoins have quickly become a leading use case for these smart contract platforms, now surpassing Visa and Mastercard in transaction volume.

And in May, two parallel developments signaled the growing institutional legitimacy of this segment. First, we saw accelerated progress on US stablecoin legislation and good bipartisan energy around defining and regulating these digital assets. This suggests that the market is poised to move from the gray zone into a more formalized environment, potentially as early as this summer if Congress can come to agreement. This clarity could unlock trillions in financial and payment rails innovation.

Second, a consortium of major banks began active discussions around launching a joint stablecoin. The idea of a unified, institutionally governed stablecoin from some of the largest banks in the world would’ve seemed highly unlikely even just a few years ago. But today, it’s on the table and could serve as a digital backbone for real-time settlement, liquidity management, and cross-border flows, positioning stablecoins as the novel programmable financial primitives for the institutional world. This week’s IPO of Circle, the issuer of USDC, the second largest tokenized dollar, with over $60 billion in market capitalization, is yet another testament of the very moment stablecoins are experiencing.

Corporate treasuries and crypto: The next frontier or unnecessary risk?

Beyond stablecoin developments, one of the more recent notable developments was the number of companies announcing they would hold BTC on their balance sheets, including GameStop and Trump Media, which announced a $2.5 billion capital raise to buy BTC. On the treasury side, activity is heating up as more companies aim to mimic the corporate bitcoin adoption approach sparked by Strategy.

May also brought the official launch of a company embracing ETH as a treasury asset. The firm aims to provide structured Ethereum allocations for institutional treasuries, positioning ETH not just as a programmable asset but as a store-of-value alternative that can generate on-chain yield while supporting broader digital finance initiatives. These crypto treasury allocations are still early and vary widely in size and intent, so it remains uncertain how they will be viewed by investors and the market more broadly.

Looking ahead

With these developments as a backdrop, we’re watching three key dynamics that are strengthening the investment case for broad exposure to crypto:

-

ETH and BTC relative strength – Will ETH continue to gain momentum against BTC, or will BTC reassert dominance as macro narratives evolve?

-

Stablecoin legislation progress – A finalized framework in the US could unleash a new wave of institutional adoption and product innovation, possibly bringing trillions of tokenized dollars to the market in the years to come.

-

Treasury strategies – Will more firms follow the lead of new BTC-focused treasury platforms? And will this be a net positive or net negative for the space?

As we near the midyear point, it’s clear that 2025 continues to signal a new phase in digital asset adoption and institutional acceptance. We continue to believe that a thoughtful, long-term allocation to digital assets will be an increasingly important feature of investor portfolios, as crypto steadily access capital pools whose size is at least one order of magnitude larger than what seemed achievable just a couple of years ago.

___________________________

This material expresses Hashdex Asset Management Ltd. and its subsidiaries and affiliates (“Hashdex”)'s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds.

The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or ser vice. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction.

These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex.

By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or other wise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and crypto assets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may var y substantially over time.

Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.” These opinions are derived from internal studies and do not have access to any confidential information. Please note that future events may not unfold as anticipated by our team’s research and analysis.

Certain information contained herein (including financial information) has been obtained from published and unpublished sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes for ward-looking statements, which can be identified by the use of terms such as “may,” “ will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof ) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such for ward-looking statements.

As a result, investors should not rely on such for ward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulator y authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any digital asset or any representation about the financial condition of a digital asset. Statements regarding Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate assets before investing. ADVICE FROM A FINANCIAL PROFESSIONAL IS STRONGLY ADVISED.